[1]LI Hailin,LIANG Ye.Research on the stock index futures hedging strategy using label propagation time series clustering[J].CAAI Transactions on Intelligent Systems,2019,14(2):288-295.[doi:10.11992/tis.201707023]

Copy

Research on the stock index futures hedging strategy using label propagation time series clustering

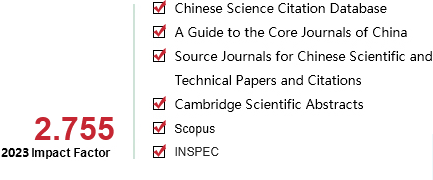

CAAI Transactions on Intelligent Systems[ISSN 1673-4785/CN 23-1538/TP] Volume:

14

Number of periods:

2019 2

Page number:

288-295

Column:

学术论文—机器学习

Public date:

2019-03-05

- Title:

- Research on the stock index futures hedging strategy using label propagation time series clustering

- Keywords:

- label propagation; time series; clustering; dynamic time warping; hedging

- CLC:

- TP391

- DOI:

- 10.11992/tis.201707023

- Abstract:

- Choosing a suitable clustering method is crucial in using time series clustering in stock index futures hedging. This study aims to investigate and improve the application performance of time series clustering in the financial data analysis field from a new perspective. We propose a model of stock index futures hedging based on label propagation time series clustering. In the model, a network space of spot stock was built using dynamic time warping as similarity measure. Each stock in the network was treated as a node, which would be divided into different clusters using label propagation, and finally, the stock data was clustered successfully. An optimization model for minimizing tracking error was constructed to obtain the optimal weight of each stock in the spot portfolio. Finally, we obtained the optimal spot portfolio. The tracking errors of the portfolio of the proposed method and that of the traditional clustering method were compared by tracking the index in the experiment. The proposed method showed the ability to improve tracking accuracy, providing a new way to enrich the investment and management of financial market.

- References:

-

[1] 柴尚蕾, 郭崇慧, 徐旭. 股指期货套利中的最优现货组合构建策略研究[J]. 运筹与管理, 2012, 21(2):154-161 CHAI Shanglei, GUO Chonghui, XU Xu. Optimal spot portfolio construction strategy in stock index futures arbitrage[J]. Operations research and management science, 2012, 21(2):154-161

[2] 郑尊信. 股指期货持有成本模型的修正与比较[J]. 哈尔滨工业大学学报, 2009, 41(2):248-250 ZHENG Zunxin. Modification and comparison of cost-of-carry model of index futures[J]. Journal of Harbin Institute of Technology, 2009, 41(2):248-250

[3] 韩立岩, 任光宇. 基于已实现二阶矩预测的期货套期保值策略及对股指期货的应用[J]. 系统工程理论与实践, 2012, 32(12):2629-2636 HAN Liyan, REN Guangyu. Hedging strategy with futures based on prediction of realized second moment:An application to stock index futures[J]. Systems engineering-theory and practice, 2012, 32(12):2629-2636

[4] HOU Yang, LI S. Hedging performance of Chinese stock index futures:an empirical analysis using wavelet analysis and flexible bivariate GARCH approaches[J]. Pacific-basin finance journal, 2013, 24:109-131.

[5] SU E D. Stock index hedging using a trend and volatility regime-switching model involving hedging cost[J]. International review of economics and finance, 2017, 47:233-254.

[6] TRABELSI N, NAIFAR N. Are Islamic stock indexes exposed to systemic risk? Multivariate GARCH estimation of CoVaR[J]. Research in international business and finance, 2017, 42:727-744.

[7] 苏治, 蔡腾腾, 马泽伟. 一种改进的不完全指数复制方法[J]. 数量经济技术经济研究, 2013, 30(6):149-160 SU Zhi, CAI Tengteng, MA Zewei. An improved solution for incomplete index tracking problem[J]. The journal of quantitative & technical economics, 2013, 30(6):149-160

[8] 倪禾. 基于启发式遗传算法的指数追踪组合构建策略[J]. 系统工程理论与实践, 2013, 33(10):2645-2653 NI He. Heuristic genetic algorithm for optimizing an index tracking portfolio[J]. Systems engineering-theory and practice, 2013, 33(10):2645-2653

[9] 胡春萍, 薛宏刚, 徐凤敏. 基于时间加权SVM的指数优化复制模型与实证分析[J]. 系统工程理论与实践, 2014, 34(9):2193-2201 HU Chunping, XUE Honggang, XU Fengmin. An stock index replicating model based on time weighted SVM and it’s empirical analysis[J]. System engineering-theory and practice, 2014, 34(9):2193-2201

[10] 刘睿智, 周勇. 指数跟踪投资组合与多信息下指数可预测性——基于Adaptive LASSO和ARIMA-ANN方法[J]. 系统工程, 2015, 33(4):1-7 LIU Ruizhi, ZHOU Yong. The portfolio of index tracing and index predictability under multi-information-Based on adaptive LASSO and ARIMA-ANN method[J]. Systems engineering, 2015, 33(4):1-7

[11] CHEN Chen, KWON R H. Robust portfolio selection for index tracking[J]. Computers and operations research, 2012, 39(4):829-837.

[12] GUASTAROBA G, SPERANZA M G. Kernel search:An application to the index tracking problem[J]. European journal of operational research, 2012, 217(1):54-68.

[13] FILIPPI C, GUASTAROBA G, SPERANZA M G. A heuristic framework for the bi-objective enhanced index tracking problem[J]. Omega, 2016, 65:122-137.

[14] DOSE C, CINCOTTI S. Clustering of financial time series with application to index and enhanced index tracking portfolio[J]. Physica A:statistical mechanics and its applications, 2005, 355(1):145-151.

[15] NANDA S R, MAHANTY B, TIWARI M K. Clustering Indian stock market data for portfolio management[J]. Expert systems with applications, 2010, 37(12):8793-8798.

[16] LEMIEUX V, RAHMDEL P S, WALKER R, et al. Clustering techniques and their effect on portfolio formation and risk analysis[C]//Proceedings of the International Workshop on Data Science for Macro-Modeling. Snowbird, UT, USA, 2014:1-6.

[17] FERREIRA L N, ZHAO Liang. Time series clustering via community detection in networks[J]. Information sciences, 2016, 326:227-242.

[18] RAGHAVAN U N, ALBERT R, KUMARA S. Near linear time algorithm to detect community structures in large-scale networks[J]. Physical review E:covering statistical, nonlinear, biological, and soft matter physics, 2007, 76(3):036106.

[19] SAKOE H, CHIBA S. Dynamic programming algorithm optimization for spoken word recognition[J]. IEEE transactions on acoustics, speech, and signal processing, 1978, 26(1):43-49.

[20] 李海林, 梁叶. 基于数值符号和形态特征的时间序列相似性度量方法[J]. 控制与决策, 2017, 32(3):451-458 LI Hailin, LIANG Ye. Similarity measure based on numerical symbolic and shape feature for time series[J]. Control and decision, 2017, 32(3):451-458

[21] LI H. Accurate and efficient classification based on common principal components analysis for multivariate time series[J]. Neurocomputing, 2016, 171:744-753.

[22] CHEN Yanping, KEOGH E, HU Bing, et al. The UCR time series classification archive[EB/OL]. 2015. (2015–07-01)[2015–12-01]. http://www.cs.ucr.edu/~eamonn/time_series_data/.

- Similar References:

Memo

-

Last Update:

2019-04-25