[1]WU Zhao-yang.Forecasting stock indexes based on a revised grey model and the ARMA model[J].CAAI Transactions on Intelligent Systems,2010,5(3):277-281.

Copy

Forecasting stock indexes based on a revised grey model and the ARMA model

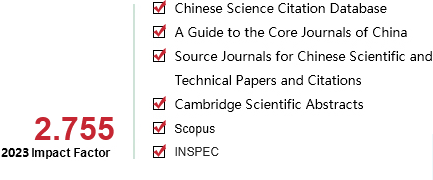

CAAI Transactions on Intelligent Systems[ISSN 1673-4785/CN 23-1538/TP] Volume:

5

Number of periods:

2010 3

Page number:

277-281

Column:

学术论文—智能系统

Public date:

2010-06-25

- Title:

- Forecasting stock indexes based on a revised grey model and the ARMA model

- Keywords:

- grey model; GM (1; 1) model; ARMA model; GMARMA model; stock prediction

- CLC:

- TP18

- DOI:

- -

- Abstract:

- A hybrid grey model—autoregressive moving average (GMARMA) model, constructed by combing the GM (1, 1) model and the ARMA model, has two drawbacks. One drawback is that the GMARMA model may not be optimal since the traditional GM (1, 1) model is not optimal. The other is that the GMARMA model does not combine two submodels properly; this may also cause the GMARMA model to be suboptimal. This paper tries to first modify the GM (1, 1) model by introducing 2 parameters, the grey dimension degree and white background value. A revised GMARMA model was constructed by optimizing all parameters in the GM (1, 1) model and the ARMA model simultaneously. For convenience, we called this revised GMARMA model the RGMARMA model. Experimental results showed that the RGMARMA model has fewer prediction errors than the ARMA model or the GMARMA model and gives a new solution for construction of hybrid models.

- References:

-

[1]朱宁,徐标,仝殿波. 上证指数的时间序列预测模型[J]. 桂林电子工业学院学报, 2006, 26(2): 124128.

ZHU Ning, XU Biao, TONG Dianbo. Timeseries prediction model of Shanghai composite index[J]. Journal of Guilin University of Electronic Technology, 2006, 26(2): 124128.

[2]POTERBA J M, SUMMERS L H. The persistence of volatility and stock market fluctuations[J]. American Economic Review, 1986, 76: 11431151.

[3]郭宁,向凤红.灰色理论和神经元网络在证券市场中的应用[J].自动化技术与应用, 2008, 27(10): 13.

GUO Ning, XIANG Fenghong.Application of grey model and neural network in the stockmarket[J].Techniques of Automation and Applications, 2008, 27(10): 13.

[4]FRENCH K R, SCHWERT G W, STAMHAUGH R F. Expected stock returns and volatility[J]. Journal of Financial Economics, 1987, 19: 329.

[5]李国平,于广青,陈森发. 中国股票价格灰色预测研究综述[J]. 东南大学学报: 哲学社会科学版, 2005, 7(2): 2830, 126.

LI Guoping, YU Guangqing, CHEN Senfa. A review of research on stock price gray forecast in China[J]. Journal of Southeast University: Philosophy and Social Science, 2005, 7(2): 2830, 126.

[6]吴庚申,梁平,龙新峰. 基于GMARMA的年电力负荷组合模型[J]. 湖北电力, 2005, 29(2): 2123.

WU Gengshen, LIANG Ping, 〖KG*1/3〗 LONG Xinfeng. 〖KG*1/3〗An 〖KG*1/3〗annual electric consumption combined model based on GMARMA[J]. Hubei Electric Power, 2005, 29(2): 2123.

[7]郝永红,王学萌. 灰色动态模型及其在人口预测中的应用[J]. 数学的实践与认识, 2002, 32(5): 813820.

HAO Yonghong, WANG Xuemeng. The dynamic model ofgray system and its application to population forecasting [J]. Mathematics in Practice and Theory, 2002, 32(5): 813820.

[8]邓聚龙.灰色系统基本方法[M].武汉:华中理工大学出版社, 1988.

[9]袁嘉祖.灰色系统理论及其应用[M].北京:科学出版社, 1991.

[10]李国平,林敬松.一种改进的灰色模型在股票价格中的应用[J].商场现代化, 2005(10): 188189.

[11]刘虹,张岐山. 基于微粒群算法的GM(1,1,λ)模型的机械产品寿命预测[J]. 机械设计, 2007, 24(10): 45, 61.

LIU Hong, ZHANG Qishan. Lifespan prediction on mechanical products of GM (1,1,λ) model based on particle swarm algorithm[J]. Journal of Machine Design, 2007, 24(10): 45, 61.

[12]谢开贵,李春燕,周家启. 基于遗传算法的GM(1,1,λ)模型[J]. 系统工程学报, 2000, 15(2): 168172.

XIE Kaigui, LI Chunyan, ZHOU Jiaqi. Gray model (GM(1,1,λ)) based on genetic algorithm[J]. Journal of Systems Engineering, 2000, 15(2): 168172.

[13]陈举华,史岩彬,沈学会. GM优化方法在机械系统寿命预测中的应用[J]. 山东大学学报:工学版, 2003, 33(4): 379381.

CHEN Juhua, SHI Yanbin, SHEN Xuehui. Application of GM( 1,1, ω*) methods in the life prediction of mechanical systems[J]. Journal of Shandong University: Engineering Science, 2003, 33(4): 379381.

- Similar References:

Memo

-

Last Update:

2010-08-27