[1]LIU Yongbo.An artificial bee colony algorithm with the feasibility rulefor portfolio investment optimizations[J].CAAI Transactions on Intelligent Systems,2014,9(4):491-498.[doi:10.3969/j.issn.1673-4785.201308047]

Copy

An artificial bee colony algorithm with the feasibility rulefor portfolio investment optimizations

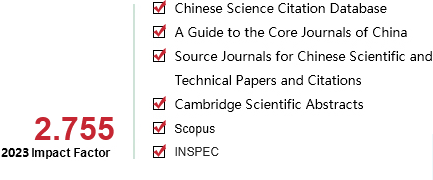

CAAI Transactions on Intelligent Systems[ISSN 1673-4785/CN 23-1538/TP] Volume:

9

Number of periods:

2014 4

Page number:

491-498

Column:

学术论文—智能系统

Public date:

2014-08-25

- Title:

- An artificial bee colony algorithm with the feasibility rulefor portfolio investment optimizations

- Keywords:

- portfolio investment; constrained optimization; artificial bee colony algorithm; feasibility rule; Markov chain

- CLC:

- TP301.6

- DOI:

- 10.3969/j.issn.1673-4785.201308047

- Abstract:

- This current work was carried out to approach the portfolio investment optimization problem by using an artificial bee colony (ABC) algorithm, in order to provide references for related researches. A constrained optimization model was constructed to formulate the portfolio investment optimization problem concerning securities subject to transaction fees and risk preferences of investors. This study employs feasibility rules to handle the constrained conditions of the optimization problem and forms an ABC algorithm with the feasibility rule (FRABC). It has been concluded by means of the Markov chain theory that the developed FRABC algorithm is globally convergent. A realistic case of the portfolio investment optimization is given to show that this method is valid and feasible, and the results are better than the ones obtained by the adaptive genetic algorithm (AGA). The proposed FRABC algorithm performs better, in terms of the final results, than the compared algorithms such as the genetic algorithm, particle swarm optimization algorithm and the basic ABC algorithm with the feasibility rule, under the assumed condition that the computational costs for the two algorithms are the same.

- References:

-

[1] 张伟, 周群, 孙德宝. 遗传算法求解最佳证券组合[J]. 数量经济技术经济研究, 2001(10): 114-116.ZHANG Wei, ZHOU Qun, SUN Debao. Genetic algorithm for portfolio investment optimizations[J]. Quantitative and Technical Economics, 2001(10): 114-116.

[2] 何洋林, 叶春明, 徐济东. 基于改进AGA算法求解含交易费用组合投资模型[J]. 计算机工程与应用, 2007, 43(11): 235-237.HE Yanglin, YE Chunming, XU Jidong. Portfolio investment model including transaction fee and solution based on adaptive genetic algorithm[J]. Computer Engineering and Applications, 2007, 43(11): 235-237.

[3] SOLEIMANI H, GOLMAKANI H R, SALIMI M H. Markowitz-based portfolio selection with minimum transaction lots, cardinality constraints and regarding sector capitalization using genetic algorithm[J]. Expert Systems with Applications, 2009, 36(3): 5058-5063.

[4] 夏梦雨, 叶春明, 徐济东. 用微粒群算法求解含交易费用的组合投资模型[J]. 上海理工大学学报, 2008, 30(4): 379-381, 386.XIA Mengyu, YE Chunming, XU Jidong. Solution of portfolio investment model including transaction fee with particle swarm algorithm[J]. Journal of University of Shanghai for Science and Technology, 2008, 30(4): 379-381, 386.

[5] 刘晓峰, 陈通, 张连营. 基于微粒群算法的最佳证券投资组合研究[J]. 系统管理学报, 2008, 17(2): 221-224, 234.LIU Xiaofeng, CHEN Tong, ZHANG Lianying. Study on the portfolio problem based on particle swarm optimization[J]. Journal of Systems and Management, 2008, 17(2): 221-224, 234.

[6] 刘衍民, 赵庆祯, 牛奔. 约束粒子群算法求解自融资投资组合模型研究[J]. 数学的实践与认识, 2011, 41(2): 78-84.LIU Yanmin, ZHAO Qingzhen, NIU Ben. Constrain particle swarm optimizer for solving self-financing portfolio model[J]. Mathematics in Practice and Theory, 2011, 41(2): 78-84.

[7] 李磊, 程晨, 张颖. 基于文化算法的投资组合规划问题求解[J]. 江南大学学报: 自然科学版, 2009, 8(1): 108-111.LI Lei, CHENG Chen, ZHANG Ying. Solving portfolio programming problem based on cultural algorithm[J]. Journal of Jiangnan University: Natural Science Edition, 2009, 8(1): 108-111.

[8] 江家宝, 尤振燕, 孙俊. 基于微分进化算法的多阶段投资组合优化[J]. 计算机工程与应用, 2007, 43(3): 189-193.JIANG Jiabao, YOU Zhenyan, SUN Jun. Multi-stage portfolio optimization using differentiation evolution algorithms[J]. Computer Engineering and Applications, 2007, 43(3): 189-193.

[9] 李国成, 肖庆宪. 基数约束投资组合问题的一种混合元启发式算法求解[J]. 计算机应用研究, 2013, (8): 2292-2297.LI Guocheng, XIAO Qingxian. Hybrid meta-heuristic algorithm for solving cardinality constrained portfolio optimization[J]. Application Research of Computers, 2013, 30(8): 2292-2297.

[10] LWIN K, QU R. A hybrid algorithm for constrained portfolio selection problems[J]. Applied Intelligence, 2013, 39(2): 251-266.

[11] PONSICH A, JAIMES A L, COELLO C A. A survey on multiobjective evolutionary algorithms for the solution of the portfolio optimization problem and other finance and economics applications[J]. IEEE Transactions on Evolutionary Computation, 2013, 17(3): 321-344.

[12] BRANKE J, SCHECKENBACH B, STEIN M, et al. Portfolio optimization with an envelope-based multi-objective evolutionary optimization[J]. European Journal on Operations Research, 2009, 199(3): 684-693.

[13] KARABOGA D, BASTURK B. A powerful and efficient algorithm for numerical function optimization: artificial bee colony (ABC) algorithm[J]. Journal of Global Optimization, 2007, 39(3): 459-471.

[14] KARABOGA D, BASTURK B. On the performance of artificial bee colony (ABC) algorithm[J]. Applied Soft Computing, 2008, 8(1): 687-697.

[15] 段海滨, 张祥银, 徐春芳. 仿生智能计算[M]. 北京: 科学出版社, 2011: 88-106.DUAN Haibin, ZHANG Xiangyin, XU Chunfang. Bio-inspired Computing[M]. Beijing: Science Press, 2011: 88-106.

[16] MALLIPEDDI R, SUGANTHAN P N. Ensemble of constraint handling techniques[J]. IEEE Transactions on Evolutionary Computation, 2010, 14(4): 561-579.

[17] 温涛, 盛国军, 郭权, 等. 基于改进粒子群算法的Web服务组合[J]. 计算机学报, 2013, 36(5): 1031-1046.WEN Tao, SHENG Guojun, GUO Quan, et al. Web service composition based on modified particle swarm optimization[J]. Chinese Journal of Computers, 2013, 36(5): 1031-1046.

[18] 张文修, 梁怡. 遗传算法的数学基础[M]. 2版. 西安: 西安交通大学出版社, 2003: 118-122.

[19] 宁爱平, 张雪英. 人工蜂群算法的收敛性分析[J]. 控制与决策, 2013, 28(9): 1554-1558.NING Aiping, ZHANG Xueying. Convergence analysis of artificial bee colony algorithm[J]. Control and Decision, 2013, 28(9): 1554-1558.

[20] 车林仙. 面向机构分析与设计的差分进化算法研究[D]. 徐州: 中国矿业大学, 2012: 21-30.CHE Linxian. Study on differential evolution algorithms orientating analysis and design of mechanisms[D]. Xuzhou: China University of Mining and Technology, 2012: 21-30.

[21] ZHANG Xiangyin, DUAN Haibin, YU Yaxiang. Receding horizon control for multi-UAVs close formation control based on differential evolution[J]. Science China Information Sciences, 2010, 53(2): 223-235.

- Similar References:

Memo

-

Last Update:

1900-01-01